In today's fast-paced financial landscape, understanding the intricacies and nuances of creditworthiness becomes undeniably crucial. Whether you desire to purchase a dream car, aspire to become a homeowner, or simply long for financial stability, optimizing your credit profile remains the quintessential key to attaining your goals.

Unlocking the doors to favorable interest rates, increased borrowing power, and improved financial opportunities necessitates a strategic approach. The strategic approach should not only involve implementing conventional methods but also harnessing the influence of lesser-known techniques. This article aims to guide you through a transformative journey toward a higher credit score, encompassing lesser-known techniques and insider insights.

Strength in Numbers: Understanding the interplay between your credit score and credit reports lies at the core of creditworthiness optimization. Each financial decision, whether monthly bill repayment or credit card usage, contributes to the creation of your credit report - a comprehensive summary of your annual financial activities. Lenders scrutinize this report to evaluate your financial health and gauge your creditworthiness. With meticulous examination, understanding, and improvement of your credit reports, the keys to a prosperous financial future can be firmly grasped.

Understanding Credit Scores

When it comes to managing your financial health, understanding credit scores is crucial. Credit scores play a significant role in determining your financial standing and eligibility for various financial services. In this section, we will delve into the essential aspects of credit scores, shedding light on their significance and how they are calculated.

1. What is a Credit Score?

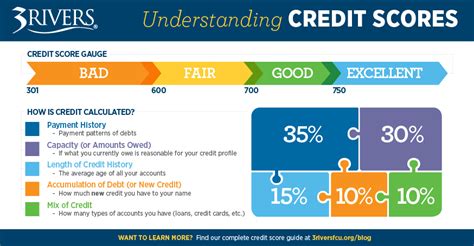

A credit score is a three-digit number that reflects an individual's creditworthiness and the likelihood of repaying borrowed funds responsibly. It is a numerical representation of a person's credit history, taking into account various factors such as payment history, credit utilization, length of credit history, types of credit used, and new credit accounts.

2. Why are Credit Scores Important?

Credit scores are crucial because lenders and financial institutions use them to assess the risk associated with lending money to individuals. A higher credit score generally indicates a lower risk, making it easier for individuals to secure loans, credit cards, mortgages, and other financial products at favorable terms.

3. How are Credit Scores Calculated?

Credit scores are calculated by specialized credit bureaus using mathematical algorithms that analyze an individual's credit report information. The most commonly used credit scoring models are FICO (Fair Isaac Corporation) and VantageScore. While the specific calculations may vary between models, the general factors considered include payment history, credit utilization, length of credit history, new credit accounts, and the types of credit used.

4. What Factors Can Impact Credit Scores?

Several factors can impact credit scores positively or negatively. Late payments, high credit card utilization, maxed-out credit cards, frequent credit inquiries, and a short credit history can all have adverse effects on credit scores. On the other hand, making timely payments, keeping credit utilization below recommended levels, maintaining a diverse mix of credit types, and having a long and positive credit history can contribute to higher credit scores.

5. How Can You Monitor and Improve Your Credit Score?

Monitoring your credit score regularly is essential to detect any discrepancies or fraudulent activities. Various credit monitoring services are available that provide access to credit reports and scores. Additionally, adopting responsible financial habits such as paying bills on time, reducing credit card balances, keeping credit utilization low, and avoiding opening unnecessary new credit accounts can help improve credit scores gradually over time.

By understanding credit scores and the factors influencing them, individuals can take proactive steps to maintain and improve their financial health. It is crucial to stay informed about credit scoring models and practice responsible financial habits to achieve a good credit score, which can open doors to better financial opportunities in the future.

Evaluating Your Current Credit Score

Assessing the status of your existing credit score is a crucial step in understanding and managing your financial health. By comprehensively evaluating your present credit score, you can gain valuable insights into your creditworthiness and take appropriate measures to enhance it.

Begin by examining your current credit score to gauge the level of risk you pose to lenders. This evaluation will help you gain a better understanding of how lenders perceive your creditworthiness and determine whether you are considered a high or low-risk borrower.

Next, delve into the various factors that contribute to your credit score, such as your payment history, credit utilization, length of credit history, and types of credit accounts. Analyzing these components will enable you to identify areas of strength and areas that need improvement in your credit profile.

Additionally, it is essential to review your credit report for any errors or inaccuracies that may be negatively impacting your credit score. Look for discrepancies in personal information, payment history, or account details, and address them promptly to rectify any potential misunderstandings or mistakes.

Furthermore, consider comparing your credit score with the average score in your age group or credit category to gain a benchmark for assessment. This will provide you with a better understanding of where you stand in comparison to others and serve as a motivator to work towards achieving a higher credit score.

Finally, make a habit of regularly monitoring and tracking your credit score to track your progress over time. By keeping a close eye on any changes in your credit score, you can take proactive steps to maintain or improve it, such as paying bills on time, reducing debt, and minimizing credit utilization.

In conclusion, evaluating your current credit score entails a comprehensive analysis of various factors that influence your creditworthiness. By thoroughly assessing your credit score, identifying areas of improvement, and monitoring changes over time, you can effectively manage your credit and work towards achieving a strong financial foundation.

Identifying Negative Factors

Uncovering the underlying reasons behind a suboptimal credit score is a crucial step towards achieving financial freedom. By identifying the various negative factors that contribute to a less-than-desirable credit standing, individuals can take proactive measures to rectify the situation and improve their overall creditworthiness.

Understanding the principal elements that impede credit scores enables individuals to evaluate their financial behavior and make informed decisions regarding their future financial endeavors. These negative factors can encompass a wide range of aspects including but not limited to missed payments, high credit utilization, limited credit history, and derogatory marks on credit reports.

Missed payments, whether they are late payments or completely skipped altogether, can have a damaging effect on credit scores. By consistently making late payments or defaulting on loan obligations, individuals signal to lenders that they are not reliable borrowers and therefore pose a higher credit risk.

High credit utilization, which refers to the ratio of credit card balances to credit limits, can also hinder credit scores. When individuals exhaust a significant portion of their available credit, it suggests an increased dependency on borrowed funds and may indicate a higher likelihood of defaulting on debts.

Having a limited credit history can make it difficult for lenders to assess an individual's creditworthiness. Without a substantial track record of responsible credit management, it can be challenging for individuals to obtain credit or secure favorable loan terms. Building a positive credit history is essential to demonstrate financial responsibility and increase credit scores.

Derogatory marks on credit reports, such as bankruptcies, foreclosures, or collections, can have a lasting impact on credit scores. These negative events indicate significant financial distress or non-payment of debts, making it harder to access credit or obtain favorable interest rates in the future.

In conclusion, recognizing and identifying the negative factors that contribute to a lower credit score is the first step towards improving one's creditworthiness. By understanding and addressing the specific factors impacting their credit standing, individuals can take appropriate measures to rectify their financial habits and pave the way for a brighter financial future.

Managing your Finances with an Effective Budget and Timely Bill Payments

One crucial aspect of enhancing your financial well-being is by effectively managing your income and expenses. In order to achieve this, it is imperative to create a budget that outlines your financial goals and helps you prioritize your spending. By allocating your income strategically and eliminating unnecessary expenses, you can optimize your financial resources and take control of your credit score.

Creating a budget entails analyzing your income sources and accurately assessing your expenses. It involves evaluating your regular bills, such as rent, utilities, and loan repayments, as well as discretionary spending on leisure activities and non-essential purchases. By categorizing your expenses and understanding where your money goes, you can identify areas where you can potentially save or reduce costs.

Once you have established a comprehensive budget, it is essential to remain disciplined and adhere to it consistently. This involves tracking your spending habits and ensuring that you allocate funds towards each category appropriately. By exercising financial discipline and avoiding unnecessary expenditures, you can free up resources to pay your bills on time.

Paying bills promptly is a fundamental principle in improving your credit score. By avoiding late payments and minimizing debt, you showcase your financial responsibility and reliability to potential lenders. Timely bill payments demonstrate your commitment towards meeting your financial obligations, which contributes to a positive credit history.

To ensure timely bill payments, consider setting up automated payments or reminders. This way, you can stay organized and avoid missing due dates. Additionally, try to allocate funds in advance for your bills to avoid any last-minute financial stress.

Managing your finances through budgeting and paying bills on time requires diligence and commitment. However, by implementing these practices consistently, you can take significant steps towards improving your credit score and achieving financial stability.

Reducing Credit Card Balances

Managing credit card balances is an important aspect of improving your financial situation and building a healthier credit history. By reducing the amount of debt you owe on your credit cards, you can positively impact your credit score and increase your chances of obtaining better interest rates and loan options.

Here are some valuable strategies to help you reduce credit card balances:

- Develop a budget: Start by evaluating your income and expenses to create a realistic budget. This will give you a clear picture of your financial situation and help you identify areas where you can cut costs to free up money for paying down your credit card balances.

- Pay more than the minimum payment: Aim to pay more than the minimum payment required on your credit cards each month. By doing so, you will reduce the principal amount owed and save money on interest charges over time.

- Focus on high-interest cards first: If you have multiple credit cards, prioritize the ones with the highest interest rates. This approach minimizes the amount of interest you will accumulate and allows you to pay off debts more efficiently.

- Create a debt repayment plan: Consider using a debt repayment strategy such as the snowball or avalanche method. The snowball method involves paying off the smallest balances first, while the avalanche method focuses on tackling debts with the highest interest rates. Choose the method that aligns best with your financial goals and preferences.

- Negotiate with credit card issuers: Reach out to your credit card companies to negotiate lower interest rates or request a lower minimum payment. Explain your financial situation and demonstrate a willingness to make on-time payments. They may be willing to work with you to find a mutually beneficial solution.

- Avoid adding new debt: While working on reducing your credit card balances, refrain from adding new debt. Delay unnecessary purchases and focus on staying within your budget to prevent further financial strain and make progress towards your goal.

- Utilize windfalls and additional income: If you receive unexpected income, such as a bonus or tax refund, consider putting a portion towards reducing your credit card balances. Using windfalls wisely can accelerate your debt repayment and bring you closer to financial freedom.

Reducing credit card balances requires discipline and dedication, but the rewards are worth it. By following these strategies, you can take control of your finances and improve your overall credit health.

Avoiding New Credit Card Applications

When it comes to managing your credit score, one key strategy to consider is avoiding the temptation to apply for new credit cards. While it can be tempting to open new lines of credit, it's important to understand the potential impact this can have on your overall credit standing.

Opening new credit card accounts can potentially have a negative effect on your credit score. Each time you apply for a new card, the credit card issuer will perform a hard inquiry on your credit report. This hard inquiry can lower your credit score, especially if you have multiple inquiries within a short period of time.

An increased number of credit card applications can also indicate to lenders that you are in need of additional funds, which may raise concerns about your financial stability and ability to manage your debt. A higher number of open credit accounts can also affect your credit utilization ratio, which is the amount of available credit you are using. A higher credit utilization ratio can also negatively impact your credit score.

Instead of applying for new credit cards, focus on managing and improving your existing credit accounts. Make sure to make your payments on time and in full, as this is one of the most important factors in maintaining a good credit score. Consider paying off any outstanding debt and reducing your credit utilization ratio by keeping your credit card balances low.

If you do need to access additional credit, explore alternative options such as personal loans or secured credit cards. These options can help you build credit without the potential negative impact of multiple credit card applications.

By avoiding new credit card applications and focusing on responsible credit management, you can work towards improving your credit score and maintaining a strong financial standing.

Reviewing Your Credit Report for Inaccuracies

When it comes to managing your financial reputation, it is essential to periodically review your credit report for any errors or inaccuracies that may be dragging down your creditworthiness. Taking the time to carefully go through your credit report can help you identify and fix any mistakes that could affect your credit score and future lending opportunities.

One important aspect of reviewing your credit report is to look out for any incorrect information that may have been mistakenly attributed to you. This could include accounts that do not belong to you, inaccurate personal information, or incorrect payment histories. Identifying and disputing these errors can help to rectify any inaccuracies and improve your credit standing.

Additionally, it is crucial to scrutinize your credit report for any signs of fraudulent activity. Detecting unauthorized accounts or unfamiliar inquiries can be an early indicator of identity theft or fraud. By promptly reporting and addressing these suspicious activities, you can protect your credit reputation and prevent further damage to your financial wellbeing.

In order to conduct a thorough review of your credit report, obtain a copy from each of the major credit bureaus and carefully scrutinize the details. Make sure to observe not only the account and payment information but also any remarks or notes associated with each account. These remarks may provide valuable insights into potential errors or issues that need to be addressed.

Remember, your credit report is a reflection of your financial history and impacts your ability to secure loans, obtain favorable interest rates, and even land certain job opportunities. Taking the time to regularly review and correct any errors ensures that your credit report truly represents your creditworthiness and maximizes your financial opportunities.

Negotiating with Lenders: Effective Approaches to Enhance your Financial Standing

Engaging in negotiations with your lenders is a crucial step towards boosting your financial health and establishing a solid credit history. By actively communicating with your creditors, you can explore various strategies to manage and improve your repayment terms, thereby ultimately enhancing your creditworthiness.

In the process of negotiating with lenders, it is vital to approach discussions with a clear understanding of your financial situation. By thoroughly assessing your income, expenses, and outstanding debts, you can confidently present a compelling case to your creditors. Properly articulating your circumstances can help foster a mutually beneficial agreement that assists you in resolving any outstanding debt efficiently.

One effective negotiation strategy involves proposing a revised payment plan that aligns with your current financial capabilities. By demonstrating a realistic repayment schedule, creditors may be more inclined to accommodate your needs and potentially offer favorable terms such as reduced interest rates or extension of payment periods. This approach showcases your commitment towards fulfilling financial obligations while also presenting a feasible solution to improve your credit standing.

Another valuable avenue for negotiation is the possibility of debt settlement. Through this process, you can propose to settle your debt by agreeing to pay a reduced amount as a final settlement. While negotiating this option, it is essential to provide evidence of your financial hardship, emphasizing that a reduced settlement amount is the most viable way to meet your obligations. The successful accomplishment of debt settlement can significantly alleviate your financial burden and contribute positively to your credit profile.

Additionally, engaging in open communication and maintaining a proactive approach during negotiations can foster a favorable outcome. Being transparent about your financial challenges and actively seeking solutions exemplifies your responsibility as a borrower. Your commitment to resolving outstanding debts and enhancing your creditworthiness can potentially lead to leniency from creditors and increased cooperation in achieving mutually beneficial resolutions.

| Key Points to Remember |

|---|

| 1. Thoroughly assess your financial situation before initiating negotiations. |

| 2. Propose a revised payment plan that suits your current financial capabilities. |

| 3. Consider debt settlement as a viable option, providing evidence of financial hardship if necessary. |

| 4. Maintain open communication and a proactive approach throughout the negotiation process. |

Seeking Professional Assistance When Needed

Exploring alternative routes towards enhancing your financial status entails considering the option of consulting with professionals who specialize in credit repair and management. The assistance of experts in the field can prove invaluable in identifying tailored strategies and solutions for your specific credit situation.

- Research credit counseling services: Invest your efforts in finding reputable credit counseling services that can guide you through the process of repairing and optimizing your credit score. These organizations typically offer personalized advice and assistance in negotiation processes.

- Consult credit repair agencies: When faced with challenging credit issues, reaching out to credit repair agencies can be a viable option. These professionals possess the expertise necessary to analyze your credit report, identify potential inaccuracies, and help dispute any errors that may be negatively impacting your score.

- Engage with financial advisors: Consider seeking guidance from financial advisors who specialize in credit management. Their comprehensive knowledge can aid in developing a strategic plan to address your credit concerns and improve your overall financial well-being.

- Explore legal assistance: In complex cases involving credit discrepancies or identity theft, it may be necessary to consult legal professionals specializing in credit law. Their expertise enables them to navigate through the intricate legal aspects and help resolve disputes that impede credit score improvement.

- Take advantage of educational resources: Many professional organizations and agencies offer workshops, seminars, and online resources on credit repair and management. These programs can equip you with valuable insights and tools to enhance your financial literacy and make informed decisions regarding your credit profile.

Remember, seeking professional help when needed is an investment in your financial future. By leveraging the expertise of individuals experienced in credit repair and management, you can navigate the complexities of the credit system more effectively and work towards achieving a stronger credit standing.

FAQ

What is a credit score and why is it important?

A credit score is a numerical representation of an individual's creditworthiness and it is used by lenders to evaluate the risk of lending money to a person. It is important because a higher credit score indicates a lower risk and can lead to better interest rates, loan approvals, and access to credit.

Can I improve my credit score if I have a history of late payments?

Yes, you can improve your credit score even if you have a history of late payments. One way is to start making all your payments on time going forward and developing a pattern of responsible payment behavior. Another strategy is to negotiate with your creditors to remove the late payment remarks from your credit report.

How can I increase my credit score quickly?

While improving your credit score takes time, there are a few actions you can take to see quick results. Paying off any outstanding balances, reducing your credit utilization ratio, and disputing any errors or discrepancies on your credit report are all proactive steps that can lead to a rapid increase in your credit score.

Is it possible to have a perfect credit score?

Technically, it is possible to have a perfect credit score, but it is extremely rare. A perfect credit score usually requires a long credit history, a diverse mix of credit accounts, a low credit utilization ratio, and a history of responsible payment behavior without any negative marks. It is more realistic to aim for a very good credit score, which can still offer the same advantages.

How long does it take to improve a damaged credit score?

The length of time it takes to improve a damaged credit score varies depending on the extent of the damage and the actions taken to improve it. Generally, it can take several months to a year or more to see significant improvements. Consistently practicing positive credit behaviors and adopting healthy financial habits will expedite the process of rebuilding your credit score.